Many sports fans and business observers often wonder about the financial ties between major figures and professional teams. It’s a natural curiosity, particularly when someone as iconic as Tom Brady, a player with such a storied career, steps into a new role beyond the field. You might be asking, "What percentage of the Raiders does Brady own?" This question, while straightforward on the surface, actually opens up a really interesting conversation about how large-scale investments are structured and how ownership stakes are often talked about in the business world. It's not always a simple number, you know?

Figuring out the exact ownership slice for someone like Tom Brady in a major sports franchise like the Las Vegas Raiders can be a bit more involved than just a quick glance. These sorts of deals, they often come with layers and different types of agreements. It’s not just about a simple percentage of a whole, like figuring out a part of 100 in a math problem, which we sometimes do, as a matter of fact. There are often other considerations, like how profits are shared, or what kind of influence an investor might have.

For anyone looking into these big-time financial arrangements, it’s helpful to understand that the public details sometimes only tell part of the story. Just like when you're looking at property deals, where you really need to understand how your money will be spent, the same care applies here. It’s a critical step in the due diligence process that many people overlook, as a matter of fact. Instead, they might just look at the total project costs without requesting a more detailed breakdown. So, let's explore what it means to talk about ownership in such a big way, and what goes into these kinds of high-stakes situations, you know?

- Which Vitamin Is Known As An Anti Cancer Vitamin

- How Is Shannen Dohertys Mom

- What Celebrity Had A Baby At 47

- What Happened To Cm Punks Arm

- How Much Did Alyssa Milano Make Per Episode Of Charmed

Table of Contents

- Tom Brady: A Brief Biography

- Personal Details and Bio Data

- The Intricacies of Team Ownership and Percentages

- How Percentages Work in Financial Contexts

- Flexibility in Investment Structures

- What to Consider When Evaluating Ownership Stakes

- FAQ: People Also Ask

Tom Brady: A Brief Biography

Tom Brady, a name synonymous with football greatness, has pretty much redefined what it means to be a successful quarterback in the National Football League. His career, spanning over two decades, is truly something else, marked by an incredible seven Super Bowl victories, more than any other player. He spent most of his playing days with the New England Patriots, building a dynasty that captured the imagination of fans everywhere, and then, you know, he went on to win another Super Bowl with the Tampa Bay Buccaneers, which was just incredible.

Beyond the football field, Brady has also ventured into various business activities, showing a keen interest in different kinds of projects. His post-playing career has seen him explore media, wellness, and, as we're discussing, potential ownership stakes in sports teams. This shift from player to proprietor is a path many athletes consider, and it often involves a lot of financial thought, you know, and really careful planning.

His story is one of consistent performance and, arguably, a deep understanding of what it takes to build something successful, whether it's a championship team or a business venture. It's almost like he brings that same dedication and strategic thinking to his financial moves as he did to his plays on the field. This kind of background makes his involvement in something like team ownership particularly interesting to many people, you know?

- What Is The Strongest Cancer Drug

- How Rich Was Julian Mcmahon

- Does Jemperli Cause Hair Loss

- What Are The First Warning Signs Of Stomach Cancer

- Did Dylan And Brenda Get Along In Real Life

Personal Details and Bio Data

| Full Name | Thomas Edward Patrick Brady Jr. |

| Born | August 3, 1977 |

| Birthplace | San Mateo, California, USA |

| College | University of Michigan |

| NFL Draft | 2000, 6th Round, 199th overall |

| Primary Teams | New England Patriots, Tampa Bay Buccaneers |

| Super Bowl Wins | 7 |

| Post-Playing Interests | Media, Wellness, Sports Ownership |

The Intricacies of Team Ownership and Percentages

When we talk about someone like Tom Brady possibly owning a piece of the Raiders, it's not always a straightforward percentage, like just a simple fraction of 100. Big investments, especially in professional sports, can be set up in some very unique ways. You see, the actual percentage of ownership might not always reflect the full scope of a person's financial commitment or their say in things. It's a bit like buying a multi-family property, whether it's a 25-unit or a 60-unit place; there are so many details beyond just the sticker price, you know?

These kinds of deals often involve complex structures, which can include different classes of shares or agreements about profit sharing that go beyond a simple equity stake. It’s not just about what percentage of the purchase price is typical to pay in closing costs, like title, inspection, appraisal, prorated taxes, or prorated insurance. There can be other aspects, too. Understanding these various components is pretty important for anyone who wants to grasp the full picture of such a big investment, you know?

For instance, an investor might have a smaller equity percentage but a larger share of the profits, or they might have specific rights that come with their investment. This is where the concept of "ownership percentage versus profit allocation percentage within an LLC" becomes very relevant. I mean, it's a question that comes up a lot in other investment areas, too, so it's not just for sports teams, obviously. It really shows how flexible these arrangements can be.

Understanding Ownership vs. Profit Allocation

It's interesting, but sometimes, a person's ownership percentage in a business might be different from their profit allocation percentage. This is a pretty common setup in various types of companies, especially those structured as LLCs. So, someone could own, say, a 5% equity stake, but their agreement might give them a 10% share of the annual profits, or vice versa, you know? This difference is something that's usually spelled out very clearly in an operating agreement.

For a high-profile individual like Tom Brady, such arrangements could be put in place to reflect a combination of financial contribution, strategic value, or even a brand ambassador role. It's not just about the money put in; it's also about the value a person brings to the table in other ways. This flexibility is a key takeaway in many investment scenarios, knowing when to apply a general rule and when to adjust based on specific conditions, you know?

This distinction is pretty important because it means that a simple percentage figure for ownership might not fully capture the economic benefit or influence an investor holds. It's a bit like how the APR on a loan is the total cost of borrowing money; understanding it is crucial because the percentage amount greatly impacts the total cost of your loan. Similarly, understanding the various percentages in an ownership deal gives you a more complete view, you know?

The Role of Due Diligence in Big Deals

Anyone who is investing in a commercial real estate deal, or really any big financial venture, should take the time to truly understand how their money will be spent. This is a critical step in the due diligence process that many people overlook, as a matter of fact. They might just look at the total project costs without requesting a more detailed breakdown, which can lead to surprises later on. It's a very, very important step, you know?

For something as significant as a stake in an NFL team, the due diligence would be incredibly thorough. It would involve looking beyond just the reported purchase price and delving into the financial health of the team, its future projections, and the specifics of the ownership structure. This is where you really get into the nitty-gritty of the deal, making sure everything aligns with expectations. It's not just a casual look; it's a deep dive, you know?

This careful examination helps to ensure that the investment makes sense, not just in terms of the initial percentage, but also for long-term returns and influence. It’s about being truly informed, which is pretty much essential for any significant financial commitment. Just like you'd want to know all the closing costs for a property, you'd want to know every detail for a team, too, obviously.

How Percentages Work in Financial Contexts

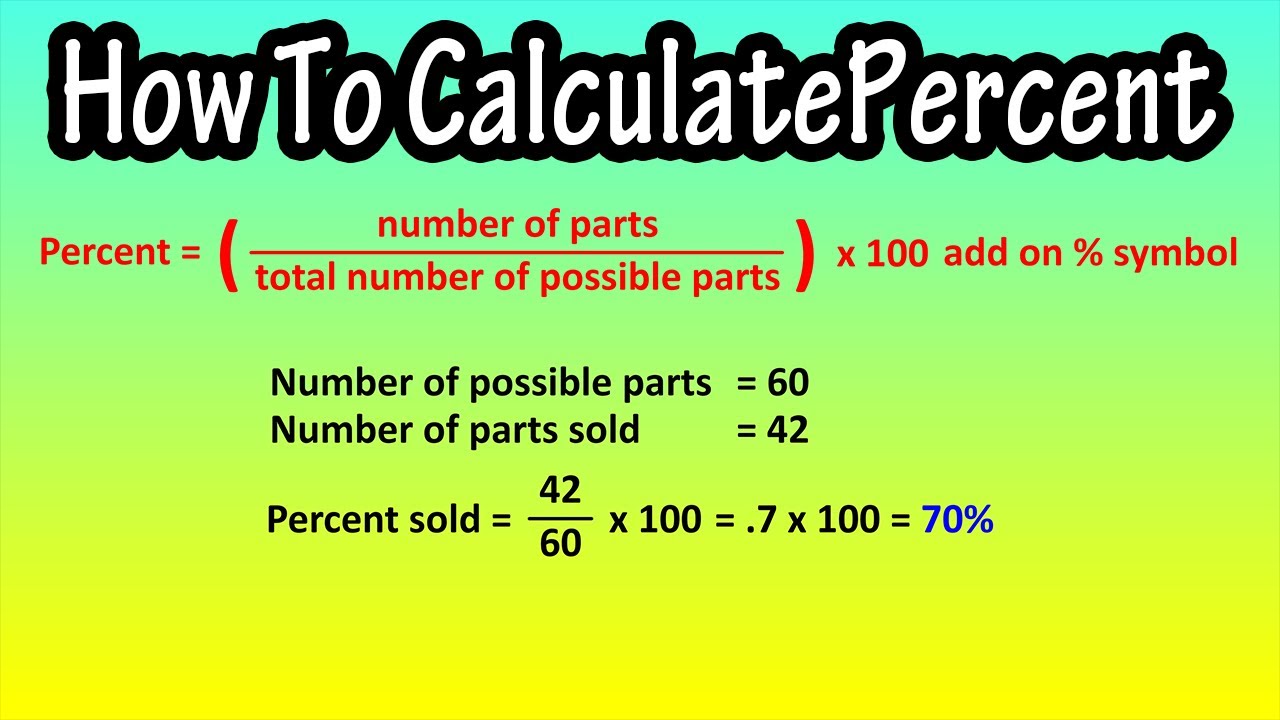

In mathematics, a percentage is a number or ratio that represents a fraction of 100. It's one of the ways to represent a dimensionless relationship between two numbers, alongside ratios, fractions, and decimals. Percentages are often denoted by the percent symbol, you know? When we talk about ownership stakes, this fundamental concept is at play, but it gets applied to very large and often complex values, as a matter of fact.

For example, if a team is valued at a certain amount, and an investor buys a percentage of it, that percentage represents their fractional share of that total value. So, if a team is worth, say, $5 billion, and someone owns 1%, that's $50 million. It sounds simple, but the valuation itself can be a complex thing to figure out. It's not just a number pulled out of thin air, you know?

Understanding how to calculate percentages is pretty useful in all sorts of financial situations. Whether it's figuring out a discount, a tax amount, or an ownership share, the basic math is the same. It's a fundamental tool for making sense of financial data, which is something you use every day, you know?

Calculating a Share

To calculate a percentage, you typically divide the part (the smaller value) by the whole (the larger value), and then multiply the result by 100. This gives you the percentage. For example, if you want to find out what percentage of a property's cost basis is attributed to land versus building, you'd use this method. It's a very straightforward way to break down a total amount into its constituent parts, you know?

In the context of team ownership, if you knew the total value of the team and the amount an investor put in, you could calculate their percentage share. However, the challenge often lies in knowing the exact "part" and "whole" figures, especially when deals are private. This is why the question of "what percentage" can be hard to answer with precision from public information, you know?

Tools like an advanced percentage calculator can be very helpful for anyone tackling percentage math—students, shoppers, or professionals. They make it easy to perform quick and accurate percentage calculations. You can enter a number and a percentage to find out what that percentage equals, or work backward to find the unknown, which is pretty handy, obviously.

APR and the Cost of Borrowing

The APR, or annual percentage rate, on a loan represents the total cost of borrowing money. Understanding APR is really crucial when applying for a mortgage, a personal loan, a credit card, or any real estate loan. The percentage amount greatly impacts the total cost of your loan over time. Therefore, comparing APRs is often the most effective method to discover the best financing offers, you know?

While an ownership stake might not directly involve an APR, the concept of a "total cost" or "total value" is still relevant. Large investments, like buying into a sports team, often involve significant financing, and the terms of that financing would certainly impact the overall economics of the deal. It's all about percentages, really, and how they add up to the bigger picture, you know?

For instance, if a portion of the investment is financed, the interest rates and repayment terms would be a critical part of the financial analysis. This is another layer of complexity that goes beyond a simple ownership percentage. It’s about looking at the full financial commitment, not just the initial equity, which is pretty important for these kinds of deals, obviously.

Flexibility in Investment Structures

Markets differ, and experienced investors often adjust the percentage based on local conditions and their exit strategy. I think the key takeaway is flexibility—knowing when to apply a general rule and when to adjust. This applies just as much to high-stakes sports team investments as it does to real estate. It's not a one-size-fits-all situation, you know?

For instance, an investment might be structured to allow for future increases in ownership, or it might be tied to certain performance metrics. This kind of adaptability is pretty common in big business deals. It allows for a more dynamic relationship between the investor and the asset, which is very useful, obviously. It's about building a deal that can grow and change with the circumstances, you know?

This flexibility also means that the initial reported percentage might not be the final or only figure to consider. There could be clauses for additional investment, or options to buy more shares later on. It's a very intricate dance of numbers and agreements, and understanding that flexibility is pretty key to making sense of it all, you know?

What to Consider When Evaluating Ownership Stakes

When you're trying to figure out the true nature of an ownership stake in something as big as a professional sports team, there's more to it than just a single percentage number. You really need to look at the whole picture. For example, what kind of control does the investor have? Is it a voting stake, or is it more of a passive financial investment? These details can make a very big difference, you know?

Also, consider the source of information. Publicly traded companies often disclose their ownership structures, but private entities, like most NFL teams, have much less stringent reporting requirements. This means that exact figures for individual investors might not be readily available to the general public. It's a bit like trying to find a good answer on Google for calculating fair month-to-month rent versus a year lease amount; sometimes, the precise answer just isn't out there in the public domain, you know?

Finally, think about the long-term goals of the investor and the team. Is this a strategic partnership, a purely financial play, or something else entirely? These broader considerations help to paint a more complete picture of what an ownership percentage truly represents. It's about understanding the "why" behind the numbers, which is pretty much essential, you know?

FAQ: People Also Ask

What is the typical percentage for minority ownership in an NFL team?

There isn't one "typical" percentage, as minority ownership stakes can vary widely, from very small fractions to significant portions. The size often depends on the total valuation of the team, the amount of capital an investor is willing to put in, and the overall structure of the ownership group. It's not a fixed rule, you know?

Are NFL team ownership details always public?

No, not always. While the principal owner and major changes in ownership are typically disclosed due to league rules and regulatory requirements, the specific details of smaller, minority ownership stakes, especially those of individual investors, are often kept private. It's a bit like how some financial details are kept confidential in private businesses, you know?

How does an investor's role differ with varying ownership percentages?

The role of an investor can change quite a bit depending on their ownership percentage. A very small percentage might mean a passive financial investment with little to no operational control, whereas a larger stake could come with voting rights, a seat on the board, and direct influence over team decisions. It's about how much say you get for your share, which is pretty important, obviously.

Related Resources:

Detail Author:

- Name : Ayla Nitzsche

- Username : elouise09

- Email : asia.franecki@flatley.net

- Birthdate : 2005-12-10

- Address : 4767 Stephany View Apt. 485 Emilemouth, OH 81807

- Phone : 1-929-945-9377

- Company : McDermott, Littel and Braun

- Job : Mixing and Blending Machine Operator

- Bio : Atque nostrum fugit commodi. Dolor tempora qui ut nostrum ducimus doloremque aliquam. Accusamus deleniti nemo nostrum ipsum quisquam.

Socials

instagram:

- url : https://instagram.com/vella8282

- username : vella8282

- bio : Et voluptatem suscipit ut qui est dicta. Quas rem ab voluptate ut debitis.

- followers : 5980

- following : 162

linkedin:

- url : https://linkedin.com/in/windlerv

- username : windlerv

- bio : Quasi totam qui nemo.

- followers : 515

- following : 455

facebook:

- url : https://facebook.com/windler1997

- username : windler1997

- bio : Veniam magnam sunt autem architecto similique et.

- followers : 1360

- following : 914