When someone talks about a big paycheck, a number like $200,000 often comes up. It sounds like a lot of money, doesn't it? For many, that figure seems like a dream, a true sign of financial comfort. But, you know, what "rich" really means can be a bit fuzzy, depending on who you ask and where they live. We're going to explore what a $200k salary truly means in today's world, and honestly, it's more complicated than just the number itself.

People often wonder if hitting that $200,000 mark means they've made it. It’s a pretty common question, particularly as living costs keep changing. So, is a 200k salary considered rich? That’s what we're here to figure out, looking at different angles and what truly shapes your money picture. We'll also clear up what "200k" even means, because, you know, it's just shorthand for two hundred thousand.

This discussion matters to anyone curious about their money journey, whether you're working towards a higher income or just trying to understand how different earnings play out. We'll look at how things like where you live, what your life looks like, and even taxes change the real value of that $200k. It's a bit like a puzzle, honestly, putting all the pieces together to see the full picture of your financial situation.

- Who Is Julian Mcmahons Mother

- What Is The Biggest Indicator Of Cancer

- What Did Holly Marie Combs Say About Alyssa Milano

- Who Is The Twin Brother Of Roman Reigns

- Who Did Shannen Doherty Sleep With On 90210

Table of Contents

- Understanding What 200k Actually Means

- The Big Picture: Income Versus Wealth

- Where You Live Matters a Lot

- Your Household and Life Choices

- Taxes and Take-Home Pay

- The Feeling of Being Rich

- Building a Secure Future Beyond the Salary

- Frequently Asked Questions About a 200k Salary

- What to Do with a 200k Salary

Understanding What 200k Actually Means

So, what exactly is "200k"? Honestly, it's just a quick way to say two hundred thousand. As a matter of fact, the "k" comes from the Greek word "kilo," which means a thousand. So, 200k equals 200,000. It's like saying "two hundred thousand," just a bit shorter. This shorthand is pretty common in money talk, you know, making big numbers easier to write and say.

When someone mentions a 200k salary, they mean earning two hundred thousand dollars in a year. For instance, Anna Paquin, Stephen Moyer, and Alexander Skarsgård, as I was saying, reportedly earned $200k per episode for their work. That's a huge amount for just one episode, showing how 200k can be a very big sum depending on the context. But for a yearly salary, it’s a different story.

This amount, 200,000, is a figure many people aim for in their careers. It sounds like a lot, and in many ways, it is. However, what it means for your daily life and overall money situation is where things get a little bit interesting. We're going to unpack that next, looking at how a big income doesn't always equal a big fortune.

- What Were The Queens Last Words

- Did Everyone Get Along On 90210

- What Is The Strongest Cancer Drug

- How Old Is Julian Mcmahon Now

- Does Kate Really Have A Tattoo

The Big Picture: Income Versus Wealth

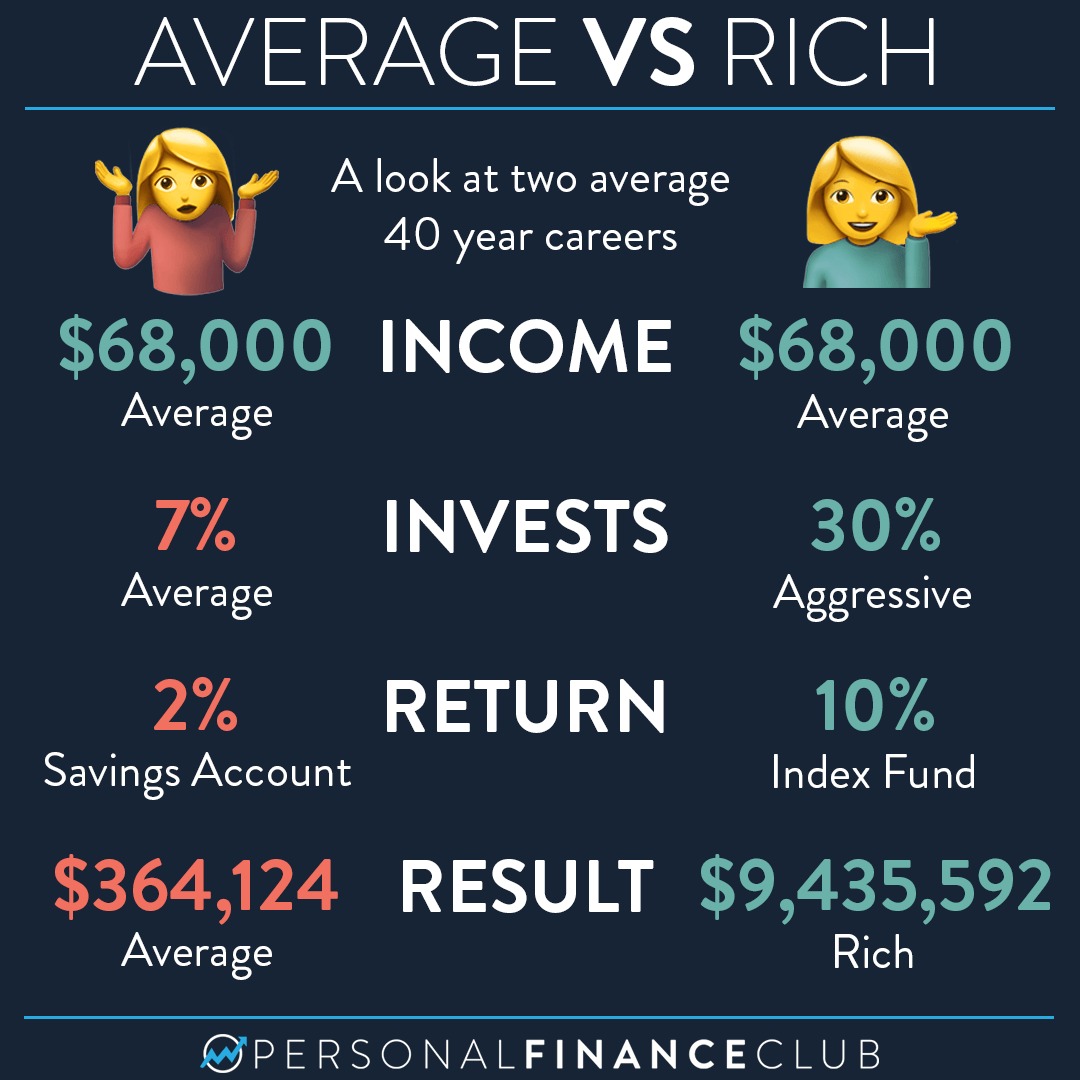

It's pretty important to tell the difference between income and wealth. You know, a $200k salary is definitely a good income. It means a lot of money coming in regularly. But having a high income doesn't automatically mean you have a lot of wealth. Wealth, you see, is what you own minus what you owe. It's your savings, investments, property, and other things of value, less your debts.

Someone could earn $200k a year but spend almost all of it, leaving little for savings or investments. On the other hand, someone earning less might be really good at saving and investing, building up a bigger pile of wealth over time. So, a high salary gives you the chance to build wealth, but it doesn't guarantee it. It's about what you do with the money, honestly.

Building wealth takes time and smart choices. It involves things like putting money into retirement accounts, investing in stocks or property, and generally making your money work for you. A $200k salary gives you a great starting point for this, but it’s just that: a starting point. It’s not the finish line, not by a long shot.

Where You Live Matters a Lot

One of the biggest things that shapes how "rich" a $200k salary feels is where you actually live. Cost of living changes so much from one place to another. A salary that feels incredibly generous in a small town might just barely cover the basics in a big city. This is, you know, a really big deal for your everyday finances.

High-Cost Areas

In places like New York City, San Francisco, or even some parts of Los Angeles, a $200k salary might not feel as grand as you'd expect. Housing costs are extremely high, for instance, whether you're renting or buying. Taxes can also be pretty steep in these areas, taking a larger chunk out of your paycheck. So, that $200k can shrink quite a bit after all the bills are paid.

Things like groceries, transportation, and even just going out can be much more expensive too. It's not uncommon for people earning $200k in these cities to feel like they're just getting by, especially if they have a family or student loan debt. In a way, it’s a good income, but it might not buy you the lifestyle you picture when you hear that number.

Lower-Cost Areas

Now, if you're earning $200k in a place with a lower cost of living, say, a smaller city in the Midwest or a rural area, that money will go much, much further. Housing is generally more affordable, and everyday expenses are often lower. This means more of your paycheck stays in your pocket, giving you more room to save, invest, or just enjoy life.

In these areas, a $200k salary could easily allow for a very comfortable life, including owning a nice home, having extra money for travel, and building up substantial savings. You might feel, you know, genuinely well-off, with less financial stress. The same number can lead to very different experiences, which is pretty interesting, honestly.

Your Household and Life Choices

Beyond where you live, your personal situation and how you choose to spend your money play a huge part in how a $200k salary feels. Every family is different, and everyone has different financial goals. So, it's not just the number, but what's happening around it, that shapes your money story.

Family Size and Dependents

If you're single with no dependents, a $200k salary is, quite simply, a lot of money for one person. You have a lot of flexibility with how you spend and save. But if you're supporting a spouse and a few kids, that same $200k needs to stretch a lot further. Kids, you know, come with their own set of costs: childcare, food, clothes, activities, and eventually, college savings. That changes things quite a bit.

A family's needs for healthcare, education, and even just daily food can quickly add up. What feels like a generous income for one person might feel like a comfortable but not extravagant income for a family of four or five. So, family size is a pretty big factor in how rich you might feel, or not feel, with that kind of money.

Debt and Financial Obligations

Student loans, credit card debt, car payments, and mortgages can eat into even a high salary. Someone with a lot of debt might find that a significant portion of their $200k salary goes straight to paying off those obligations. This leaves less for daily living, savings, or fun things. It's a bit like having a leaky bucket, honestly, where a lot of the water just goes out.

On the other hand, someone with little to no debt will have much more disposable income from the same $200k salary. They can save more, invest more, or simply enjoy their earnings without the burden of large monthly payments. Debt, you know, can really change your financial picture, even with a good income.

Spending Habits and Lifestyle

Your personal spending habits also make a huge difference. If you have a taste for luxury cars, designer clothes, frequent expensive vacations, and dining out every night, even $200k might not feel like enough. Lifestyle creep, where your spending goes up with your income, is a very real thing. It can make a high salary feel less impactful.

However, if you live a more modest lifestyle, are mindful of your spending, and prioritize saving, that $200k salary can build significant wealth over time. It's about choices, really. You can decide to live below your means and save a lot, or you can spend freely and find yourself always wanting more. It's a personal thing, you know, how you handle your money.

Taxes and Take-Home Pay

When we talk about a $200k salary, it's important to remember that this is your gross income, meaning before taxes and other deductions. After federal income tax, state income tax (if applicable), Social Security, Medicare, and maybe even retirement contributions or health insurance premiums, your actual take-home pay will be much lower. This is, you know, a very important point.

The exact amount you take home will vary depending on your tax bracket, deductions, and where you live. For example, someone living in a state with no state income tax will keep more of their $200k than someone in a high-tax state. It's a bit of a complex calculation, but suffice it to say, you won't see all $200,000 hit your bank account. So, your net income, what you actually get, is what truly matters for your budget.

The Feeling of Being Rich

Beyond the numbers, "rich" is also a feeling. For some, it means having enough money to never worry about bills. For others, it's about having the freedom to pursue passions, travel, or spend time with loved ones without financial constraints. A $200k salary certainly provides a strong foundation for financial security and freedom, but it doesn't automatically mean you'll feel rich. It's a bit subjective, you know, what that word means to each person.

If you're constantly comparing yourself to others who earn more or spend more, you might not feel rich, even with a $200k salary. Financial contentment often comes from within, from feeling secure and having your needs met, rather than from a specific income number. It's about perspective, really, and what truly makes you feel financially comfortable. Honestly, it's a personal journey.

Building a Secure Future Beyond the Salary

A $200k salary offers a wonderful chance to build a truly secure financial future. It's not just about spending it, but about making smart choices with it. This means thinking about things like saving for retirement, setting up an emergency fund, and perhaps investing in things that grow your money over time. You know, it's about planning ahead.

With this level of income, you have the capacity to save a significant portion of your earnings, which can lead to financial independence much faster than with a lower income. Consider putting money into a 401(k) or IRA, and maybe even exploring other investment avenues. Learning more about personal finance strategies can really help you make the most of your earnings. It’s a pretty good opportunity, honestly, to set yourself up for later.

Also, don't forget about protecting your assets. Things like insurance, both health and property, are very important. Making sure your finances are in order, and that you have a plan for the future, can give you a lot of peace of mind. To be honest, it's a critical part of feeling truly secure, no matter your salary. You can also explore options like how to manage your investments for long-term growth.

Frequently Asked Questions About a 200k Salary

People often have questions about what a $200k salary truly means. Here are a few common ones, you know, to help clear things up.

Is a 200k salary good for a family of four?

A $200k salary for a family of four can be quite comfortable in many places, but it really depends on your location and lifestyle. In high-cost areas, it might cover basic needs but leave less for extras or significant savings. In lower-cost areas, it could provide a very good quality of life with plenty of room for savings and discretionary spending. It's a bit of a mixed bag, honestly, depending on where you are.

How much is 200k after taxes?

The amount of $200k you take home after taxes varies quite a bit. Factors include federal income tax, state income tax (if your state has one), Social Security, Medicare, and any deductions like retirement contributions. Generally, you can expect to take home somewhere between $120,000 and $150,000, but this is just a rough estimate. It's pretty important to look at your own pay stub to see the exact figures.

What kind of lifestyle can you have with 200k?

With a $200k salary, you can usually enjoy a comfortable lifestyle. This might include living in a nice home, having a reliable car, enjoying hobbies, and taking vacations. However, the exact lifestyle depends on your expenses, debt, and spending habits. If you manage your money well, you can save for big goals and still enjoy life. It's about choices, you know, and how you prioritize your spending.

What to Do with a 200k Salary

Having a $200k salary presents a fantastic opportunity to build real financial strength. It's not just about earning the money, but about using it wisely. You know, a good plan can make all the difference. Think about setting up a budget, for instance, so you know exactly where your money is going. This helps you see areas where you might be able to save more or spend less on things that don't truly matter to you.

One very smart move is to prioritize saving and investing. Try to automate your savings, so a portion of your paycheck goes straight into a savings account or investment fund before you even see it. This makes it much easier to build up your money over time. Consider putting money into a retirement account, like a 401(k) or an IRA, as soon as you can. The sooner you start, the more your money can grow, which is pretty amazing, honestly.

You might also want to pay down any high-interest debt you have. Things like credit card balances can really eat away at your income, making it harder to get ahead. Getting rid of that debt frees up

Related Resources:

:max_bytes(150000):strip_icc()/GettyImages-951745458-bcfd88122f5a4d17bfda51c875f2fd7d.jpg)

Detail Author:

- Name : Florida Denesik

- Username : carley.johnston

- Email : zion.runte@yahoo.com

- Birthdate : 1988-08-05

- Address : 69014 Wintheiser Fort North Justicefurt, MO 60994

- Phone : +1-757-747-6865

- Company : Pfeffer PLC

- Job : Education Administrator

- Bio : Odit dolores quia doloremque sunt sed aperiam. Quam et eius itaque quam vitae. Et enim in facilis consequatur quam.

Socials

twitter:

- url : https://twitter.com/gleason1975

- username : gleason1975

- bio : Hic quos consectetur velit et eaque rem voluptatem. Blanditiis totam adipisci nisi libero hic. Tempore in maiores tempore quia tempora dolores mollitia dicta.

- followers : 3539

- following : 1640

instagram:

- url : https://instagram.com/gleasonj

- username : gleasonj

- bio : Sed nulla numquam ipsa. Iste porro ipsum vitae officiis. Rerum qui et eius expedita numquam.

- followers : 5673

- following : 366

linkedin:

- url : https://linkedin.com/in/jacinthe.gleason

- username : jacinthe.gleason

- bio : Soluta velit eum facilis quia dolores.

- followers : 6791

- following : 135

facebook:

- url : https://facebook.com/jacinthe_dev

- username : jacinthe_dev

- bio : Facere repellat excepturi ut voluptatem.

- followers : 6824

- following : 2894